The North American Free Trade Agreement (NAFTA) is one of trade’s greatest success stories for food and agriculture. The trilateral agreement between the United States, Canada and Mexico removed many tariff and non-tariff barriers that paved the way for U.S. agricultural exports to our two partners to quadruple from $11 billion in 1993 to over $43 billion in 2016.

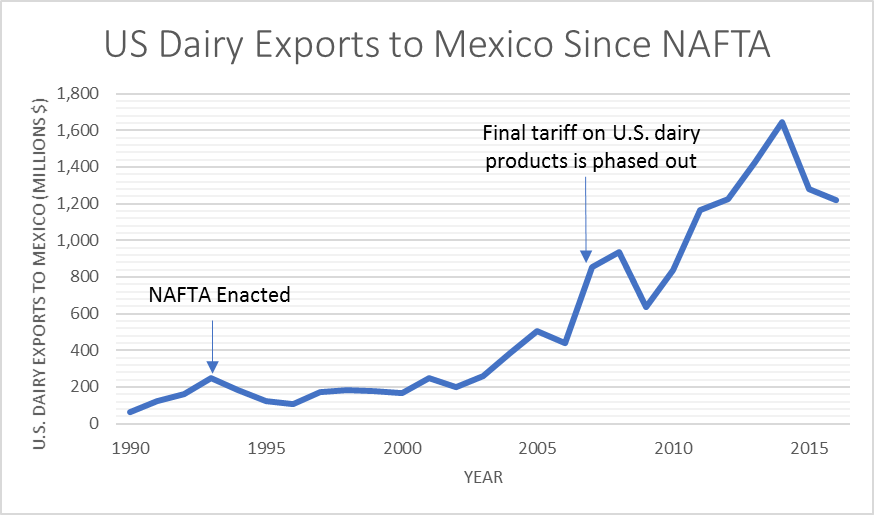

For the U.S. dairy industry, NAFTA marked an important shift from a net importer of milk and milk products to one of the top exporting countries in the world, thanks in large part to newly opened borders for dairy products between the U.S. and Mexico. As seen in the graph, the U.S. dairy exports to Mexico have more than quintupled over the span of the agreement and rapidly accelerated as tariffs were phased out, leading to record sales in U.S. dairy products to a single country in 2014 of over 1.6 billion dollars! Thanks to Mexican market access achieved in NAFTA, U.S. dairy companies support thousands of more jobs here in the U.S.

Despite the clear benefits of NAFTA for U.S. agriculture, especially in the dairy industry, the 25-year-old agreement still requires modernization to bring the agreement into the 21st century. On May 18, 2017, President Trump provided written notice to Congress with his intention to renegotiate NAFTA “to support higher-paying jobs in the United States and grow the U.S. economy by improving U.S. opportunities under NAFTA.”

Although there are several areas that demand reform, for IDFA, the first priority of negotiations must be on maintaining current access to the Mexican dairy market. Thanks to the elimination of tariffs between the two countries and the U.S.’s competitive advantage in dairy, the U.S. accounts for 73% of Mexico’s total dairy imports. However, if the United States threatens to withdraw from NAFTA or Mexican customers worry about volatility in U.S. supply if negotiations regressed, Mexico could look to elsewhere to satisfy domestic demand. The Congressional Research Service affirms that discussions with potential alternative suppliers in New Zealand and the European Union have already begun.

However, in spite of the success of the trade agreement with regards to Mexico, the agreement remains incomplete for U.S. dairy. When first negotiated, dairy market access to Canada was largely left out of the agreement – in part due to Canada’s supply management system, wherein the government heavily influences the pricing, marketing and production of the dairy sector. To maintain this system, Canada relies on import quotas with severe out-of-quota tariff rates to restrict dairy imports. Without renegotiation of NAFTA, U.S. dairy will continue to be saddled with prohibitive tariffs of a minimum of 200 percent and up to 313.5 percent.

“NAFTA renegotiation should address Canada’s very limited tariff-rate quotas (TRQs) and high in-quota and out-of-quota tariffs on U.S. dairy products,” declared Beth Hughes in IDFA’s comments on NAFTA renegotiation. “Elimination of all tariff-rate quotas and tariffs are the ultimate goal of any free trade agreement.”

Beyond Canada’s TRQs, several non-tariff barriers remain unsettled within NAFTA:

Ingredient Pricing Strategy

The first, and perhaps most egregious, of the non-tariff barriers erected on U.S. dairy exports is Canada’s new ingredient pricing strategy that effectively blocks imports of ultrafiltered (UF) milk and many dairy ingredients from the Canadian market. Under its supply management regime, Canadian milk prices are well above U.S. and world market prices. So, to make their milk products more competitive on the world market, Canada must subsidize their exports.

One way of Canada has sought to achieve this is through employing a special class program that sets artificially low prices for UF milk and other dairy ingredients that disincentivizes the purchase imports from the United States and other markets and subsidizes Canadian exports. As a direct result of this program, U.S. exports of UF milk to Canada have virtually stopped, thereby blocking a $150 million market for U.S. dairy processors and threatening hundreds of jobs. Additionally, through effectively subsidizing skim milk powder (SMP) at below the cost of production, the new class program also further enables the dumping of SMP on the world market that violates WTO export subsidy commitments.

In the NAFTA renegotiation, Canada must agree to remove its special class pricing programs and language must be incorporated into the agreement to ensure that Canada does not institute other pricing programs or non-tariff barriers that negatively impact dairy trade and jobs.

Read more on Canada’s ingredient pricing strategy.

Geographical Indications (GI)

For IDFA and the U.S. dairy industry, it is essential that NAFTA incorporates text on the issue of GIs and common names. Geographical Indications, or GIs, recognize the unique nature of specialty foods products identified with a specific geographic area. They restrict the use of the names of these products only to those that originate in the designated area. By allowing consumers to easily recognize these unique food products, GIs serve a necessary and useful purpose. However, attempts by the European Union to eliminate competition from producers in other countries have resulted in troubling precedents that restrict the use of common food names, such as parmesan, gorgonzola, or asiago, in Mexico and Canada without due process through separate agreements.

In renegotiating NAFTA, the United States should utilize the language in the Trans-Pacific Partnership that was agreed upon by all three countries to preserve market access for common food names.

Read more on geographical indications.

Other Non-Tariff Barriers to Trade

Finally, IDFA supports the three signatories remove other non-tariff barriers to trade, including sanitary and phytosanitary measures (SPS) or unnecessarily restrictive regulations. For instance, Canadian compositional standards limit the amount of dry milk protein concentrate in cheese making reduce the demand for U.S. ingredients. Additionally, enhancing SPS provisions to ensure food safety regulations are science-based and consistent with trade obligations should be a key goal of negotiators.

IDFA Members can see more detailed analysis and information if they login in at the top of the page.

For information about IDFA membership, contact us at membership@idfa.org.